Summer Savings on Horizon Mortgages and Short-Term Capital Lending

Horizon Mortgages Reduced Interest Loan Terms and Conditions

Introduction

The promoter of this promotion (“the Offer”) is Horizon Loans Pty Ltd ACN 651 491 799 of Level 21, 101 Grafton Street, Bondi Junction NSW 2022.

Horizon Loans offers reduced interest rates to Eligible Applicants, subject to the terms and conditions of the Offer.

Eligible Applicants agree to be bound by these terms and conditions by applying for an Eligible Horizon Loans Reduced Interest Loan.

Any Horizon Loans offers to Eligible Applicants remain in the absolute and sole discretion of Horizon Loans. Any application which is withdrawn will not be eligible for qualification despite resubmission.

Definitions

In these terms and conditions:

(a) Horizon Loans means Horizon Loans Pty Ltd ACN 651 491 799 and includes any of its agents, contractors, subsidiaries and related parties from time to time;

(b) Applicant means the party named as a Borrower or Guarantor in respect to an application for a Horizon Loans Reduced Interest Loan(s);

(c) Apply means you as an individual or co-borrower have applied via Horizon Loans, Broker or Other third-party channels and Horizon Loans has confirmed receipt of your application;

(d) Eligible Applicants means applicants that meet all the Eligibility Criteria as per the Eligibility Criteria section;

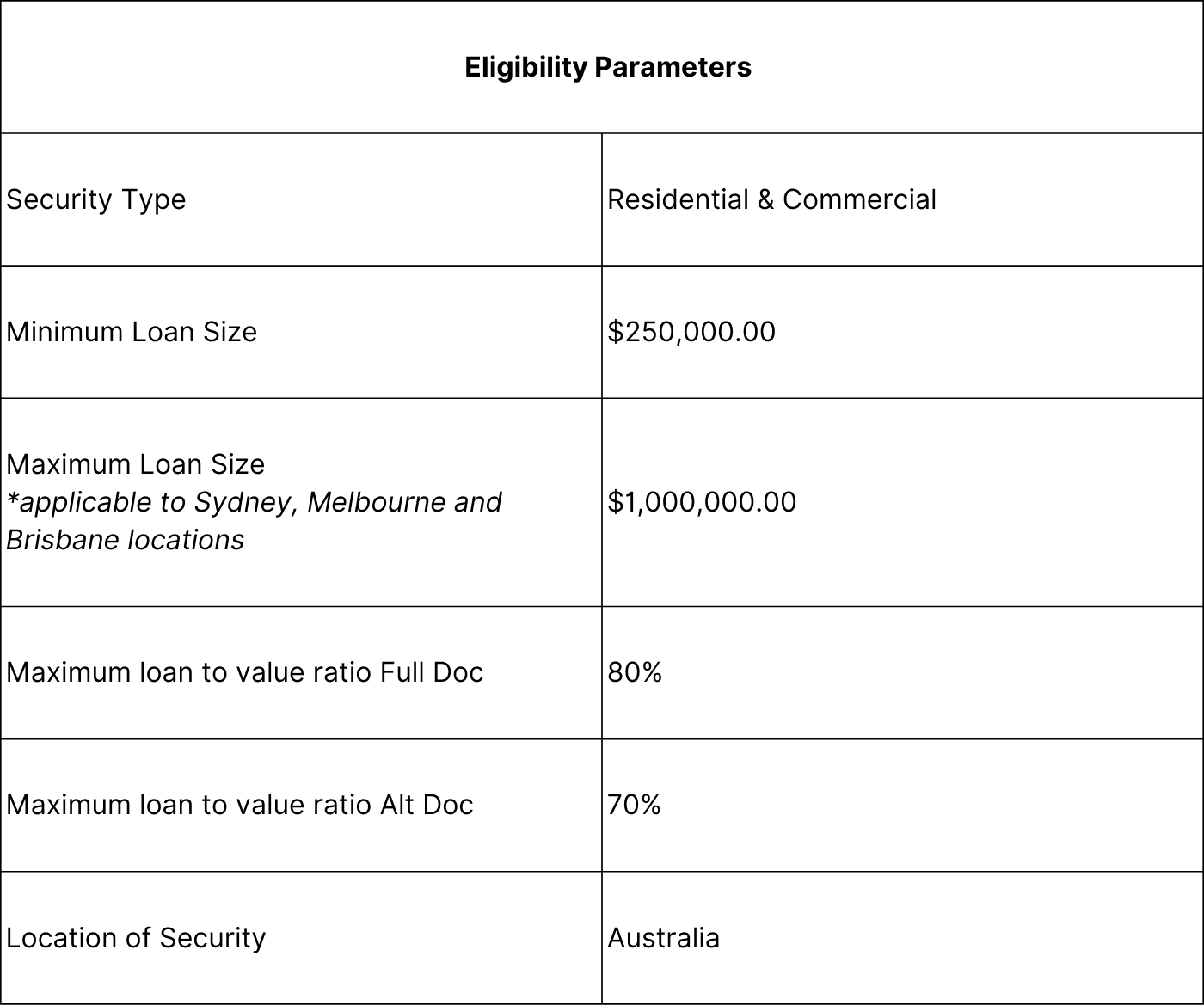

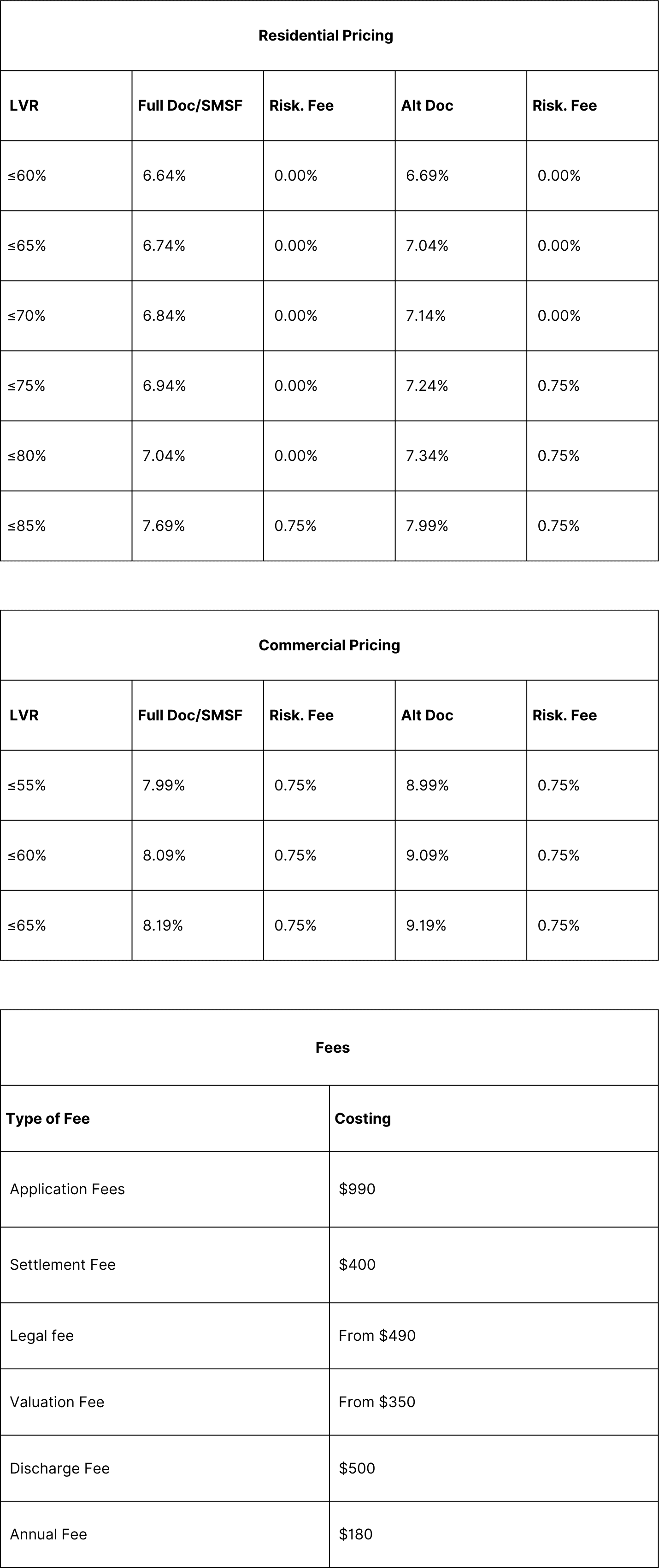

(e) Eligible Horizon Loans Reduced Interest Loan means a Loan agreement entered into by the Applicant to which this Offer applies and which meets the following eligibility parameters (the Eligibility Parameters):

(f) Full Doc means when a full verification of income is provided.

(g) Alt Doc means when alternative documentation is provided when full verification of income is not provided.

(h) Lower Interest Rate means the lower or discount interest rate as defined under an offer for an Eligible Horizon Loans Reduced Interest Loan.

Eligibility Criteria

You are eligible to participate in this Offer if:

(a) You Apply from 11 November 2024 to 24 January 2025;

(b) Your application(s) to Horizon Loans relates to one or more Eligible Horizon Loans Reduced Interest Loan which satisfy the Eligibility Parameters; and

(c) You drawdown that Eligible Horizon Loans Reduced Interest Loan(s) within 30 days from applying.

Operation of Reduced Interest Rate

The reduced interest rate set out in this Offer operates such that any offer for an Eligible Horizon Loans Reduced Interest Loan will have a reduced Lower Interest Rate, fees subject to LVR levels as follows:

The reduced interest rate does not apply to any extended period of the Eligible Horizon Loans Reduced Interest Loan beyond its initial term.

Any Lower Interest Rate expressed in an offer for an Eligible Horizon Loans Reduced Interest Loan is deemed to have the reduction in rate already applied.

No Representations or Warranties

Except as required by law, Horizon Loans makes no representations or warranties with respect to this Offer or any benefits or entitlements under the Offer.

Taxes and Duties

You acknowledge and agree that you are solely responsible for any taxation liability you may incur in relation to your participation in the Offer or your Eligible Horizon Loans Reduced Interest Loan, and any associated taxation implications.

Exclusions

Without limiting any other provision of these terms and conditions, this Offer is not available in connection with, or in addition to, any other Horizon Loans offer, promotion, rebate or benefit.

Variation and Termination

Horizon Loans may vary these terms and conditions from time to time, including by:

(a) adding, withdrawing or substituting any benefits available to you under the Offer;

(b) varying the reduction of the reduced interest rate under this Offer;

(c) varying the period to which this Offer applies;

(d) changing the eligibility criteria or requirements that must be met to receive benefit of the interest reduction.

Horizon Loans may terminate or withdraw this Offer at any time without prior notice.

Horizon Loans may reject, cancel, or reverse any benefit conferred from the grant of the interest reduction if it has reasonable grounds to believe that a person’s conduct or dealings with respect to an Eligible Horizon Loans Reduced Interest Loan, the Offer or any other dealings with Horizon Loans may be fraudulent or otherwise illegal.

If you are not satisfied with any change or variation Horizon Loans makes to the Offer, you can terminate your participation at any time by providing written notice to Horizon Loans.

Other Matters

Horizon Loans reserves the right to disqualify any person who participates in the Offer but does not comply with these terms and conditions or who tampers with the Offer process.

Failure by Horizon Loans to enforce any of its rights at any stage does not constitute a waiver of those rights.

All applications for credit, are subject to Horizon Loans credit approval criteria. Terms and conditions, fees and charges, and other eligibility criteria apply.

These terms and conditions are:

(a) separate to the terms and conditions of each applicable Eligible Horizon Loans Reduced Interest Loan; and

(b) do not form part of the credit contract for any of your Eligible Horizon Loans Reduced Interest Loan.

To the extent of any inconsistency between these terms and conditions and the terms and conditions of your Eligible Horizon Loans Reduced Interest Loan, the terms and conditions of your Eligible Horizon Loans Reduced Interest Loan prevail.

Short-Term Capital Lending Reduced Interest Loan Terms and Conditions

Introduction

The promoter of this promotion (“the Offer”) is Assetline Investments Pty Ltd ACN 619 252 210 of Level 21, 101 Grafton Street, Bondi Junction NSW 2022.

Assetline offers reduced interest rates to Eligible Applicants, subject to the terms and conditions of the Offer.

Eligible Applicants agree to be bound by these terms and conditions by applying for an Eligible Assetline Reduced Interest Loan.

Any Assetline offers to Eligible Applicants remain in the absolute and sole discretion of Assetline. Any application which is withdrawn will not be eligible for qualification despite resubmission.

Definitions

In these terms and conditions:

(a) Assetline means Assetline Investments Pty Ltd ACN 619 252 210 and includes any of its agents, contractors, subsidiaries and related parties from time to time;

(b) Applicant means the party named as a Borrower or Guarantor in respect to an application for an Assetline Reduced Interest Loan(s);

(c) Apply means you as an individual or co-borrower have applied via Assetline, Broker or Other third-party channels and Assetline has confirmed receipt of your application;

(d) Eligible Applicants means applicants that meet all the Eligibility Criteria as per the Eligibility Criteria section;

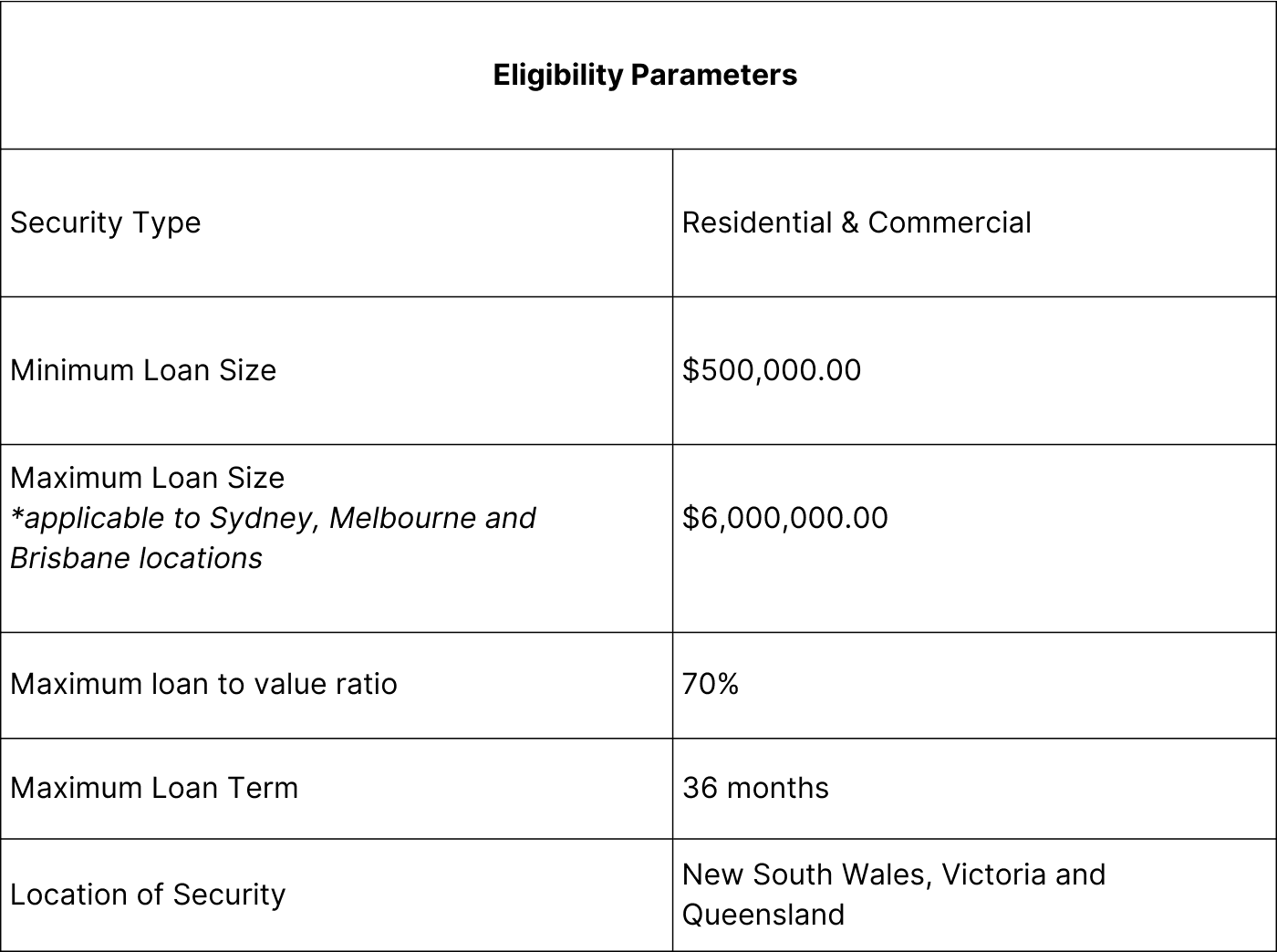

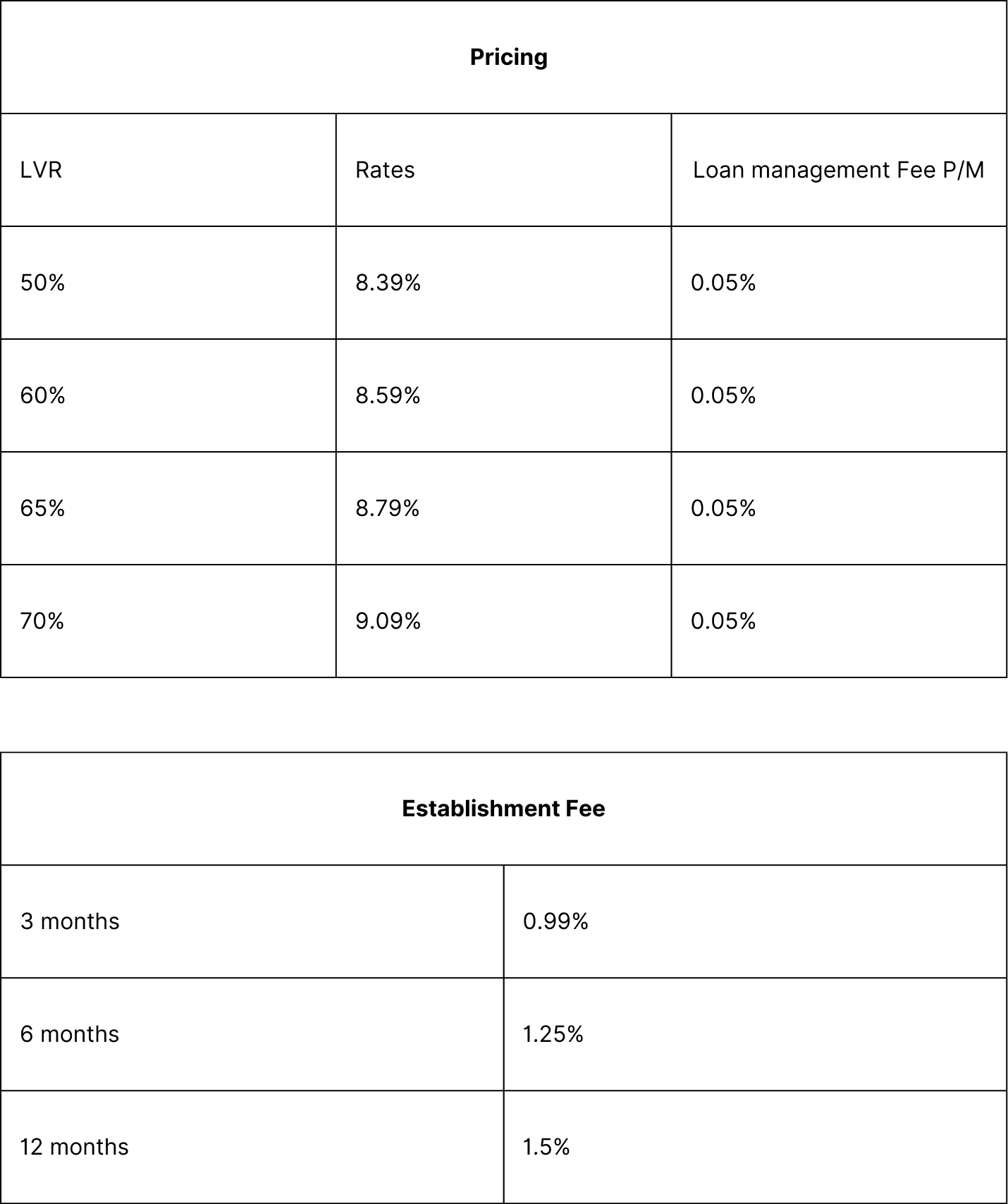

(e) Eligible Assetline Reduced Interest Loan means a Loan agreement entered into by the Applicant to which this Offer applies and which meets the following eligibility parameters (the Eligibility Parameters):

(f) Lower Interest Rate means the lower or discount interest rate as defined under an offer for an Eligible Assetline Reduced Interest Loan.

Eligibility Criteria

You are eligible to participate in this Offer if:

(a) You Apply from 11 November 2024 to 24 January 2025;

(b) The applicant(s) has a credit score of greater than 550;

(c) The applicant(s) have nil arrears on any loan amounts being refinanced;

(d) Any previously paid defaults no greater than $500.00;

(e) The applicant(s) is not a discharged bankrupt;

(f) Your application(s) to Assetline relates to one or more Eligible Assetline Reduced Interest Loan which satisfy the Eligibility Parameters; and

(g) You drawdown that Eligible Assetline Reduced Interest Loan(s) within 30 days from applying.

Operation of Reduced Interest Rate

The reduced interest rate set out in this Offer operates such that any offer for an Eligible Assetline Reduced Interest Loan will have a reduced Lower Interest Rate, fees subject to LVR levels as follows:

The reduced interest rate does not apply to any extended period of the Eligible Assetline Reduced Interest Loan beyond its initial term.

Any Lower Interest Rate expressed in an offer for an Eligible Assetline Reduced Interest Loan is deemed to have the reduction in rate already applied.

No Representations or Warranties

Except as required by law, Assetline makes no representations or warranties with respect to this Offer or any benefits or entitlements under the Offer.

Taxes and Duties

You acknowledge and agree that you are solely responsible for any taxation liability you may incur in relation to your participation in the Offer or your Eligible Assetline Reduced Interest Loan, and any associated taxation implications.

Exclusions

Without limiting any other provision of these terms and conditions, this Offer is not available in connection with, or in addition to, any other Assetline’s offer, promotion, rebate or benefit.

Variation and Termination

Assetline may vary these terms and conditions from time to time, including by:

(a) adding, withdrawing or substituting any benefits available to you under the Offer;

(b) varying the reduction of the reduced interest rate under this Offer;

(c) varying the period to which this Offer applies;

(d) changing the eligibility criteria or requirements that must be met to receive benefit of the interest reduction.

Assetline may terminate or withdraw this Offer at any time without prior notice.

Assetline may reject, cancel, or reverse any benefit conferred from the grant of the interest reduction if it has reasonable grounds to believe that a person’s conduct or dealings with respect to an Eligible Assetline Reduced Interest Loan, the Offer or any other dealings with Assetline may be fraudulent or otherwise illegal.

If you are not satisfied with any change or variation Assetline makes to the Offer, you can terminate your participation at any time by providing written notice to Assetline.

Other Matters

Assetline reserves the right to disqualify any person who participates in the Offer but does not comply with these terms and conditions or who tampers with the Offer process.

Failure by Assetline to enforce any of its rights at any stage does not constitute a waiver of those rights.

All applications for credit, are subject to Assetline’s credit approval criteria. Terms and conditions, fees and charges, and other eligibility criteria apply.

These terms and conditions are:

(a) separate to the terms and conditions of each applicable Eligible Assetline Reduced Interest Loan; and

(b) do not form part of the credit contract for any of your Eligible Assetline Reduced Interest Loan.

To the extent of any inconsistency between these terms and conditions and the terms and conditions of your Eligible Assetline Reduced Interest Loan, the terms and conditions of your Eligible Assetline Reduced Interest Loan prevail.